Join Singapore’s nationwide e-invoicing initiative to accelerate payments, reduce costs, and improve efficiency.

TeBS E-Invoicing is a secure, efficient, and government-recognized solution that allows businesses to send and receive invoices electronically through the InvoiceNow network, built on Peppol standards. No printing. No scanning. No retyping.

- → As simple as sending an email

- → UEN-based routing (like PayNow for invoices)

- → Fully interoperable across countries

Singapore’s e-invoicing framework has evolved — it is no longer just about sending and receiving e-invoices. From 2025 onwards, InvoiceNow is aligned with GST reporting and is now referred to as “GST InvoiceNow.”

This integration helps businesses automate invoice data submission to IRAS, improving compliance and reducing manual filing burdens.

TeBS is proud to be an IMDA-accredited InvoiceNow Ready Solution Provider (IRSP), enabling seamless connection to the Peppol network for automated e-invoice exchange and compliance. AI service solution is ready to support the latest IRAS and GST integration requirements to help businesses of all sizes achieve efficiency, accuracy, and regulatory alignment.

TeBS is proud to be an IMDA-accredited InvoiceNow Ready Solution Provider (IRSP), enabling seamless connection to the Peppol network for automated e-invoice exchange and compliance. AI service solution is ready to support the latest IRAS and GST integration requirements to help businesses of all sizes achieve efficiency, accuracy, and regulatory alignment.

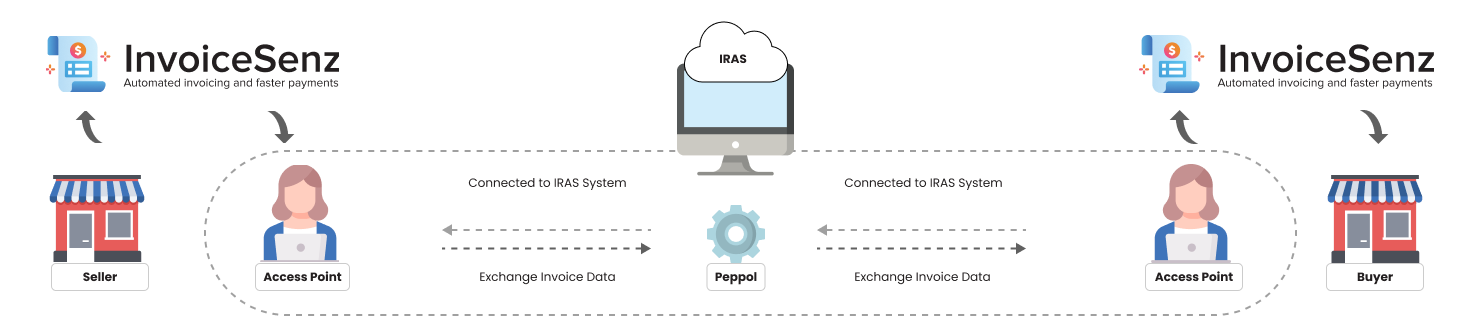

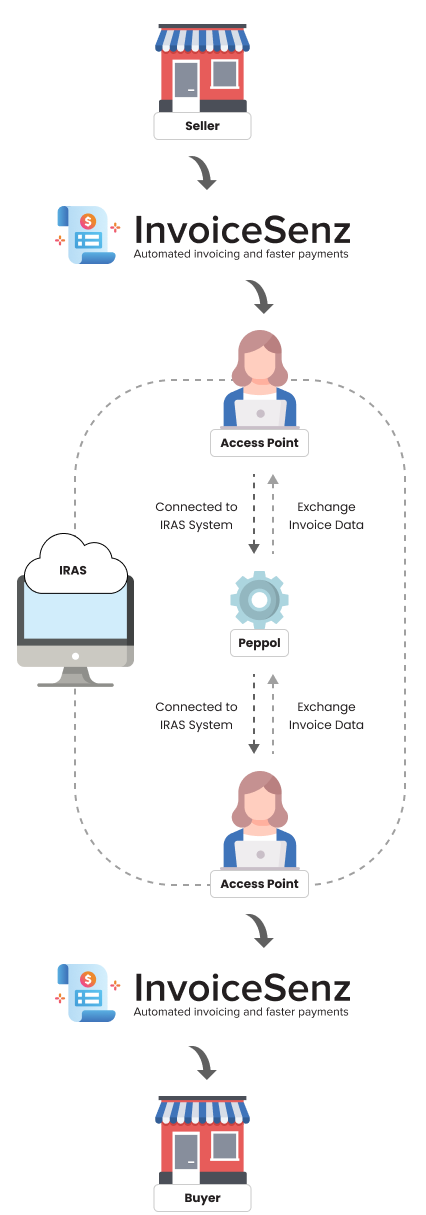

The GST InvoiceNow initiative is a collaborative effort by the Inland Revenue Authority of Singapore (IRAS) and the Infocomm Media Development Authority (IMDA) to streamline GST reporting through digital invoicing. Leveraging Singapore’s InvoiceNow network, which is built on the Peppol framework, businesses can transmit standardized e-invoices directly between systems, enhancing efficiency and compliance.

GST-registered companies are required to adopt InvoiceNow-compatible solutions to facilitate automatic invoice data submission to IRAS.

Step 1

Check if your current system is **Peppol-ready**

Step 2

Register your interest in the TeBS portal

Step 3

TeBS will be in touch to setup, onboard, and provide support for enabling eInvoicing

InvoiceNow is a nationwide e-invoicing initiative in Singapore, built on the PEPPOL network. Unlike traditional paper or PDF invoices, InvoiceNow enables businesses to send structured e-invoices directly between accounting systems — no printing, scanning, or retyping needed.

GST InvoiceNow is the upgraded version of the InvoiceNow framework, integrating e-invoicing with GST reporting to IRAS. From 2025, it will become mandatory for newly incorporated companies and later for all GST-registered businesses. It simplifies compliance by automating invoice data submission to IRAS.

TeBS InvoiceSenz helps you:

- Accelerate payment cycles

- Reduce manual effort and invoice errors

- Stay compliant with evolving IRAS requirements

- Ensure secure, cross-border invoice exchange

- Get expert support from an IMDA-accredited provider

The onboarding process is quick and simple. Once you connect with us, we handle system checks, access point setup, and provide training. Most businesses can start transacting electronically within a few days.

In a common business scenario today, an PDF e-invoice is sent to the recipient organisation by email. This is a single-sided operation requiring your recipient to re-enter the details of the invoice into their own accounting system (e.g. accounts payable). A more complete solution should include the transmission of data from supplier system to buyer system without human intervention and potentially allow for the InvoiceNow invoice to be paid seamlessly.

The implementation timelines of 1 Nov 2025 and 1 Apr 2026 apply to new voluntary GST registrants only. IRAS will publish more information on the implementation timeline for existing GST-registered businesses and new compulsory GST registrants when available

There is no limit on the number of line items per invoice. However, we recommend keeping it to no more than 999-line items per invoice. Please note that the total XML file size must not exceed 10MB per submission

There is no character limit set for data element / field for submission to IRAS. However, businesses should consult their accounting solution / enterprise system providers, as the maximum character length that businesses can key into the data elements/field is typically limited by their solution’s / system’s userinterface

Self-billing invoices must be submitted to IRAS via the Solutionextracted method, as they fall outside the InvoiceNow network. The customer-issuer must use Type 2 Submission, while the supplier-recipient uses Type 3 Submission. Refer to the e-Tax Guide for mandatory data requirements.

The GST InvoiceNow Requirement does not preclude businesses from their existing GST responsibilities. GST-registered businesses must continue to file their GST returns and keep proper business and accounting records.